QUBIC BLOG POST

Qubic All-Hands Recap: A New Governance and Funding Framework Takes Shape

Written by

The Qubic Team

Published:

Feb 7, 2026

Listen to this blog post

The All-Hands took place on February 5, 2026

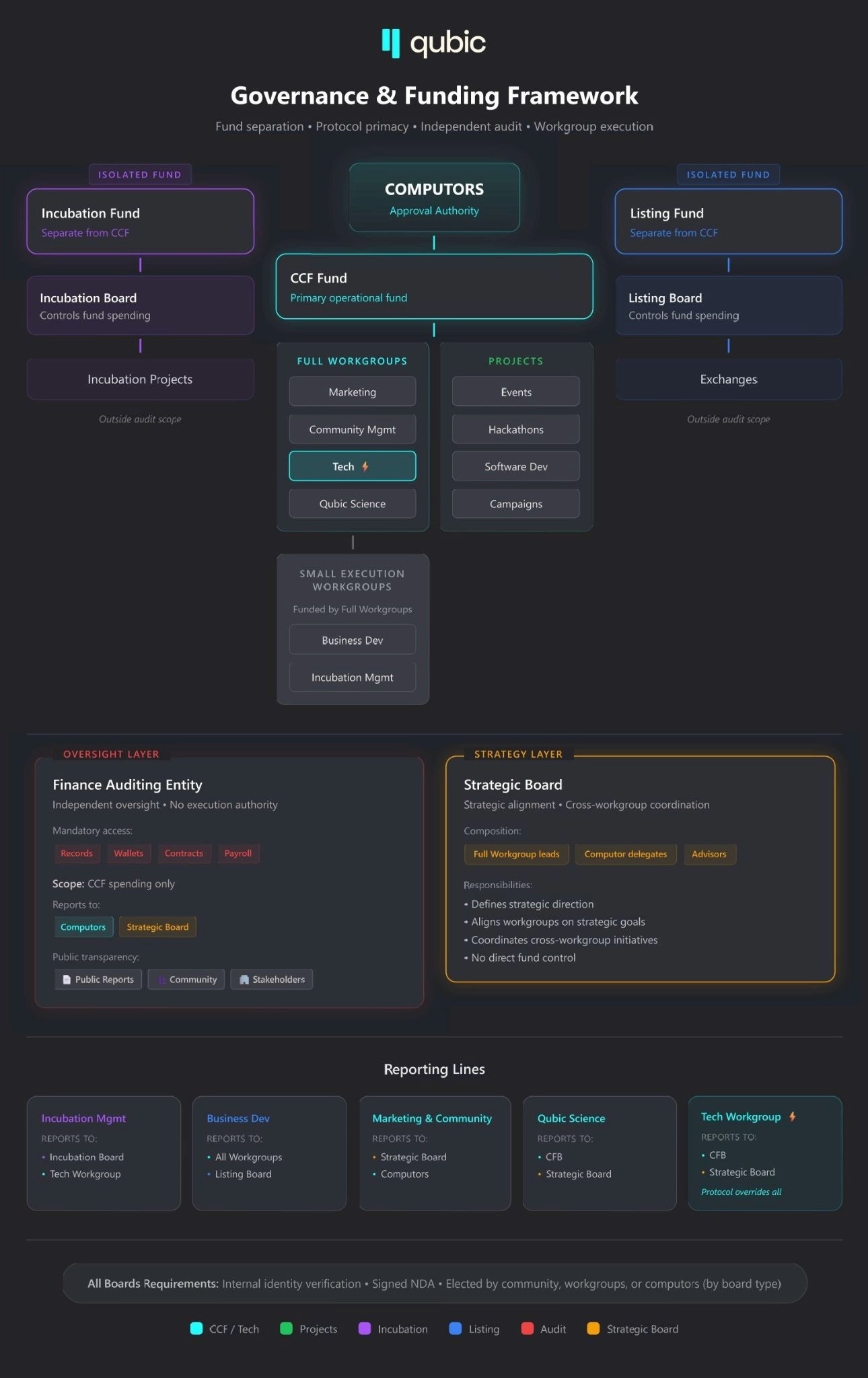

With over 2,000 community members tuning in live, the Qubic team unveiled something that had been quietly taking shape behind the scenes for weeks. This wasn't a typical all-hands call. JOETOM, Mr. Rose, and DeFiMomma walked the community through a brand-new Governance and Funding Framework designed to bring structural clarity, decentralized fund management, and real accountability to how Qubic operates going forward.

In a space where blockchain governance remains one of the hardest problems to solve, Qubic is putting a concrete structure on paper and letting the Computors vote on it.

The framework is built on four pillars. Here's what each one means for the ecosystem.

Fund Separation: Three Isolated Pools for Transparent Crypto Project Management

The biggest structural change centers on splitting ecosystem funding into three distinct pools with strict separation between them.

The Computor Controlled Fund (CCF) remains the primary operational fund. It's a smart-contract-managed pool where no single person holds the keys. Workgroups submit proposals, and Computors vote to approve funding. The CCF covers salaries, running costs, and project-specific expenses like events, campaigns, or new initiatives. Going forward, all CCF spending will be subject to independent auditing through a new oversight layer.

The Incubation Fund is completely isolated from the CCF. It exists solely to finance incubation projects and is governed by a newly formed Incubation Board. The Incubation Program operates with its own dedicated pool of $QUBIC reserved for ecosystem growth. If the community donates for incubation purposes, that money stays in the incubation lane.

The Listing Fund follows the same principle of isolation. It covers exchange-related costs: new listings, fiat on-ramp integrations, and anything tied to getting $QUBIC onto trading platforms. The Listing Board controls this fund and makes all strategic decisions about when and where to invest.

The reasoning is straightforward. Donations earmarked for exchange listings shouldn't fund incubation projects. CCF budgets approved for workgroup operations shouldn't be redirected into listing fees. Isolated pools ensure that funds go exactly where stakeholders intended, nothing more, nothing less. This kind of transparent fund segregation is increasingly recognized as essential for sustainable blockchain projects.

Decentralized Decision-Making vs. Execution: Who Does What in Qubic's Governance

The framework draws a hard line between the people who build and the people who set direction.

Full Workgroups are the execution layer. There are four active ones right now: Marketing (led by DeFiMomma), Tech (led by JOETOM), Science (led by Dav), and Community Management (currently led by El-Clip, with a transition underway). These teams build, operate, and deliver. They don't control CCF funding or set the strategic direction of the project.

Small Execution Workgroups operate as extensions of the full workgroups. Business Development (Kimz300) and Incubation Management (Mr. Rose) fall into this category. They're funded by the workgroups themselves rather than directly by the CCF, which keeps them running at the same operational pace as the teams they extend.

The Strategy Layer sits above execution and consists of three boards:

Listing Board: Strategic Exchange and Liquidity Management

The Listing Board includes JOETOM, Crypdro, MrUnhappyX, Eko, Zgirt, and Spikeinjapan. They control the Listing Fund, decide exchange strategy, approve listing expenditures, and set prioritization. Their current stance: hold the money and wait for the right moment. No spending on low-volume or region-specific exchanges. When the $QUBIC price and volume increase, the same reserved funds will stretch significantly further for a meaningful listing.

Incubation Board: Growing the Qubic Ecosystem

The Incubation Board is newly formed and includes JOETOM, Dkat, Crypdro, Jecd, mksala, mio, and Mr. Rose. This board defines incubation program strategy, approves projects, and shapes the overall structure of how ecosystem incubation works within Qubic's growing ecosystem.

Strategic Board: Cross-Workgroup Coordination

The Strategic Board is still in development. It will include full workgroup leads, Computor delegates (to be elected), and advisors. Its job: Align all workgroups on common goals, coordinate cross-group initiatives, and serve as the first arbiter when conflicts arise. Critically, it holds no direct fund control.

Independent Financial Oversight: Blockchain Accountability in Practice

This one is entirely new for Qubic.

Over the past six months, tensions within the community arose around how funds were being used. At the same time, workgroup members felt exposed and vulnerable to public scrutiny without a proper mechanism to verify their spending was above board. The framework addresses both sides of that equation.

A Finance Auditing Entity will be brought in as an independent third party. This entity will have mandatory access to financial records, wallets, contracts, and payroll for all CCF-funded activities. It will audit expenditures, determine whether funds are being used properly, and publish public reports for the community. The Incubation and Listing Funds sit outside the scope of this CCF-focused audit.

The auditing entity reports directly to Computors and the Strategic Board. The entity itself is still being sourced. Requirements will be published by the end of February, a candidate shortlist is expected by mid-March, and the entity should be fully operational by April 15.

Introducing third-party financial auditing puts Qubic ahead of most blockchain projects when it comes to operational transparency. Combined with the 676-Computor quorum-based consensus that already governs the protocol, it adds a layer of financial accountability that matches the network's technical decentralization.

Protocol Primacy: Why the Qubic Protocol Is the Ultimate Authority

When conflicts happen (as they will), the framework lays out a clear escalation path.

For general conflicts between workgroups or boards, the Strategic Board acts as first arbiter. If the board can't find common ground, the decision escalates to Computors as the final authority.

For protocol-related conflicts, the chain is different. Core tech steps in first as the protocol custodian. If they can't resolve it, CFB (Sergey Ivancheglo, Qubic's founder) gets involved. And if no resolution comes from either, the protocol itself serves as the ultimate arbiter.

The principle of Protocol Supremacy means that no governance decision can override protocol constraints. The protocol's integrity takes structural priority over everything else. This is a non-negotiable boundary in the framework, and it reinforces Qubic's core philosophy of decentralized, code-driven governance.

Governance Rollout Timeline: Three Phases to Full Operation

Phase 1 - Alignment (Now through Feb 18)

Much of the governance structure is already active. Workgroups, boards, and the CCF funding mechanism (8% Computor contribution) are all running. The next steps are about getting community and Computor buy-in on the framework itself. Public feedback runs until February 9. Framework refinement happens February 9–11. Computors vote on February 12. If approved, the framework activates February 18.

Phase 2 - Filling the Gaps (Feb through mid-April)

Three key roles still need to be filled:

Community Lead: Candidate applications opened February 6, interviews happen February 12, and the final candidates list goes up February 17. Computors vote on the new lead by February 25, followed by a 10-day handover period to ensure a smooth knowledge transfer.

Finance Auditing Entity: Requirements by February 28, candidate shortlist by March 15, fully operational by April 15.

Strategic Board (full form): The Computor delegates process kicks off February 28, elections happen by March 31, and the board becomes fully operational by April 15.

Phase 3 - Funding Sustainability (Feb through May)

With governance locked in, the team plans to tackle a deeper question: how to make the Incubation and Listing Funds self-sustaining, rather than CCF-dependent. A proposal outline goes to Computors on February 24. Feedback collection continues through March 15. Refinement wraps up in April. Computors vote April 30, with full operation targeted for May 15.

Q&A Highlights

Oracle Machines Update

Not on mainnet yet, but still on the radar and planned for the next protocol update. Oracle Machines will connect real-world data to Qubic smart contracts, enabling a new class of dynamic decentralized applications.

Doge Integration Timeline

The devs' current target is end of Q1 for mainnet integration. The team emphasized this is an estimate, not a hard commitment. Discovery of critical issues during testing could push the date back.

Vottun Bridge Audit

The smart contract audit starts February 10. fnordspace is validating milestones two and three. Everything on Vottun's side is finalized. Now it's about validation and passing the audit.

Solana Bridge Progress

The team building it is delivering on schedule, but they have an open position for a Qubic smart contract developer. If that role stays unfilled, delays become a risk. Developers interested in contributing can reach out to Tokenoya, the project lead.

Tier-1 Exchange Listing Strategy

The Listing Board's current position: hold funds and wait for better market conditions. The logic is practical. If $QUBIC's price increases, the reserved listing funds become worth significantly more in dollar terms. Spending funds now on a tier-1 listing at current volumes doesn't deliver the return the community expects. You can track $QUBIC's current market position on CoinMarketCap.

$QUBIC Token Supply and Halving Schedule

The goal is to never reach the 200 trillion supply cap. Qubic has halvings along with consistent weekly token burns built into its tokenomics, with the next halving one planned for August 2026. As supply approaches the cap, the emission rate naturally slows. Combined with execution fee burns, smart contract IPO burns, XMR Mining burns, and oracle consumption, more $QUBIC should be burned than created.

What's Coming Next for Qubic in 2026

Core-Tech has committed to publishing a three-to-four-month planning update covering core protocol development, incubation, and client/integration infrastructure. That update is expected within several days following the AMA.

A dedicated proposal channel will open on Discord where community members can ask detailed questions about the governance framework, review supporting documents and diagrams, and provide feedback before the Computor vote. If you want to dig deeper into Qubic's 2026 vision, the previous All-Hands recap provides a broader strategic context.

The Takeaway: Structured Decentralized Governance for Qubic's Future

This governance framework represents the most structured operational blueprint Qubic has put forward. It separates money, decisions from execution, introduces independent financial oversight, and hard-codes the protocol as the ultimate authority.

The team acknowledged this is a lot to digest in a single session. That's why the feedback window, Discord proposal channel, and phased rollout exists. Nothing activates without Computor approval.

One final note from the call worth highlighting: Qubic was ranked top three on LunarCrush for social engagement this week, sitting right next to World Liberty Fi. In a tough market, the community's collective voice is making noise. That momentum, paired with a governance structure built for the long haul, sets up what could be a defining year for Qubic.

Stay connected:

Follow Qubic on X · Join the Discord community · Explore the Qubic Ecosystem · Read the Whitepaper · Check the Docs