QUBIC BLOG POST

From Epoch 100 to 200: Ten Milestones That Transformed Qubic

Written by

The Qubic Team

Published:

Feb 16, 2026

Listen to this blog post

Epoch 100: Qubic had built a protocol the rest of crypto said was impossible. It worked. But working and proving it to the world are different problems. Useful Proof of Work was still a concept and most of the world had never heard of it. AI training on a blockchain was a whitepaper promise. Deflationary tokenomics was still a model on paper. The ecosystem had only a handful of projects.

By Epoch 200, theory became reality.

Between Epoch 100 and Epoch 200, Qubic shipped the kind of progress that other protocols promise across entire funding cycles. An 80% max supply cut. A live CertiK speed record. A 51% Monero hashrate takeover that made international headlines. Three hackathons. A halving. Protocol-native oracle machines entering mainnet testing.

This is the story of ten milestones that turned a niche Layer 1 blockchain into one of the most technically ambitious projects in crypto.

1. Project X Rewrites Qubic's Tokenomics (Epoch 123, August 2024)

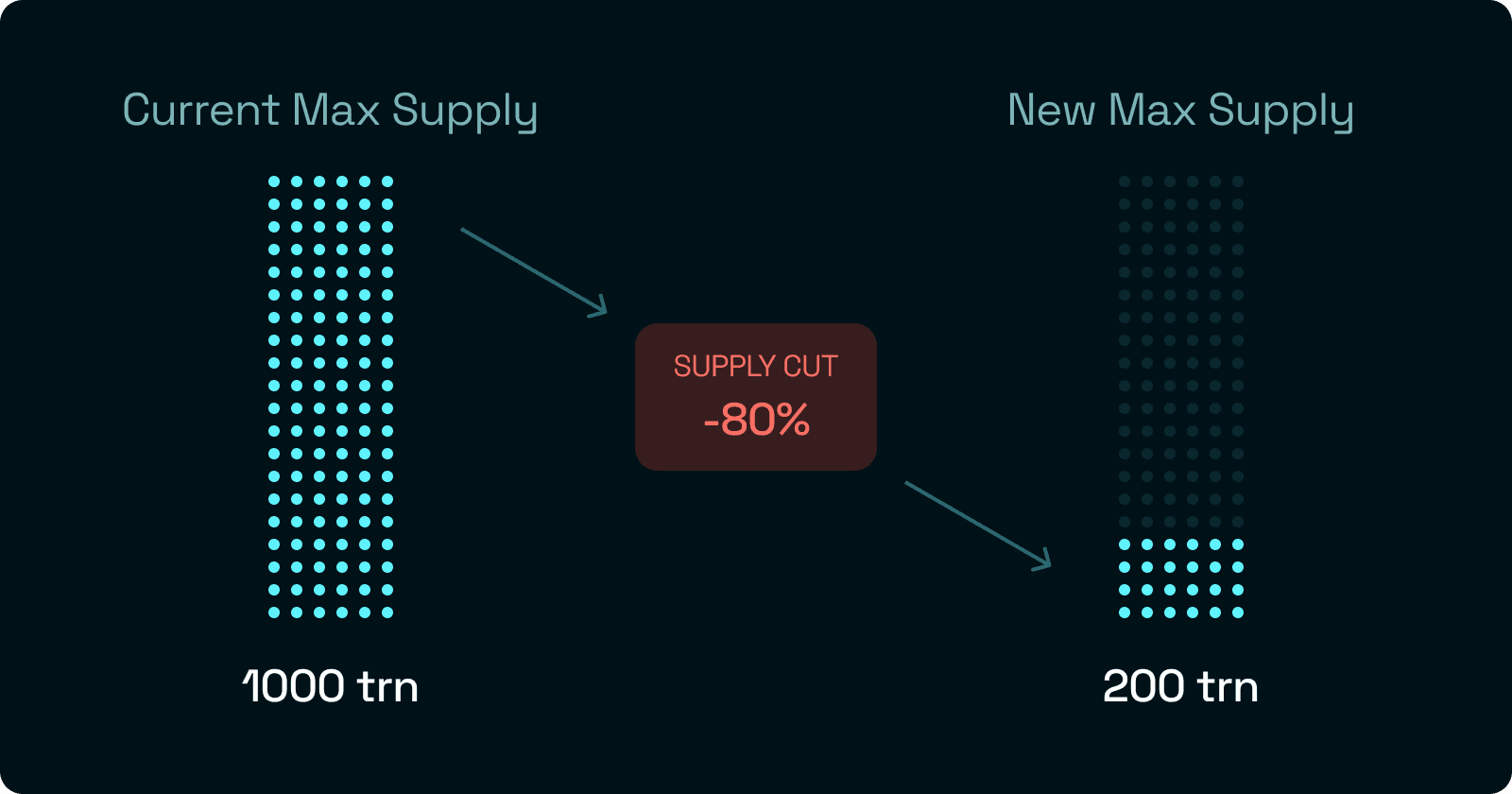

Before Project X, Qubic's hard supply cap sat at 1,000 trillion Qubic, projected to reach capacity around 2041. The weekly emission of 1 trillion Qubic remained constant, and the broader market understandably questioned long-term sustainability.

The community pushed back. The team listened.

Announced on August 1, 2024 as a four-day rollout, Project X restructured Qubic's entire economic engine.

Metric | Before Project X | After Project X |

Max Supply | 1,000 trillion Qubic | 200 trillion Qubic |

Weekly Emission Burn | 0% | 15% |

Fully Diluted Valuation | ~$1.7 billion | ~$340 million |

But the supply cut was only one piece. Project X introduced three interconnected mechanisms built on a new protocol extension developed by Joetom and the core team. The Computor Controlled Fund (CCF) redirected 8% of weekly emissions toward software development, marketing, and ecosystem projects. QEarn gave holders a reason to lock their tokens for yield. And the Supply Watcher smart contract was designed to dynamically adjust burn rates based on real-time supply data, preventing both runaway inflation and over-deflation.

By Epoch 124, the new emission model was live, with its first reduction removing nearly 149 billion Qubic from circulation. The market responded with renewed confidence.

2. QEarn Locks Nearly 18% of Total Supply (Epoch 138 Onward)

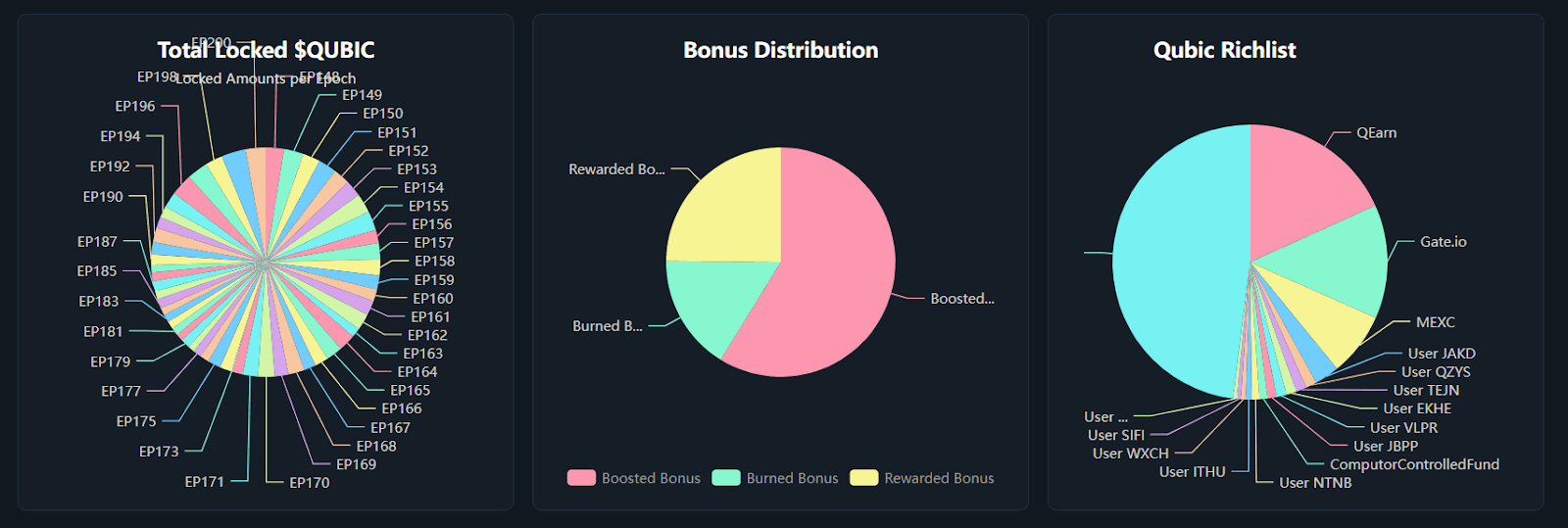

QEarn launched at Epoch 138 as the staking layer born out of Project X. The premise was straightforward: lock Qubic for a set duration, earn yield, reduce circulating supply.

The numbers tell the story better than any pitch deck. As of the most recent data, 29.5 trillion Qubic sits locked in QEarn, representing 17.885% of the total supply. That locked amount has generated 577 billion Qubic in burns, with an average APY holding at 13.77%.

A dedicated dApp launched in March 2025, giving users real-time data on locked balances, APY rates, and pending rewards. WalletConnect integration brought mobile wallet support. The interface tracked lock history, allowed direct locking and unlocking, and removed the friction of interacting with raw smart contracts.

QEarn proved something that tokenomic theories often fail to deliver in practice: when the incentive design is right, people hold.

Nearly one in five Qubic tokens is currently off the market by choice, not by restriction.

3. CertiK Certifies Qubic as the Fastest Blockchain in History (Epoch 157, April 22, 2025)

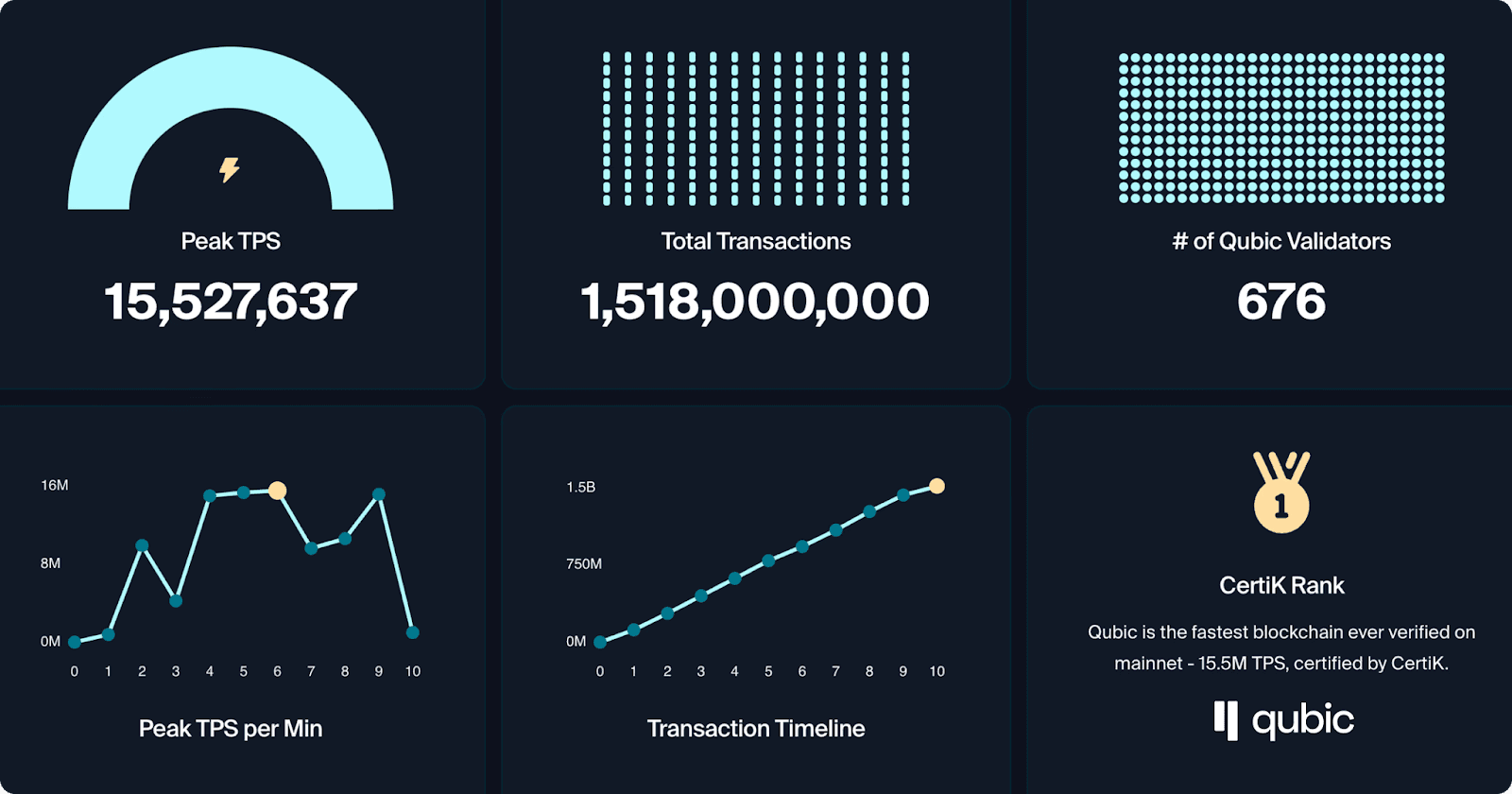

Qubic processed 15.52 million transactions per second on its live Layer 1 mainnet. CertiK independently verified and published the result.

This was not a testnet burst. Not a simulated environment. Not an L2 trick. The stress test ran on Qubic's production mainnet using its native tick-based architecture, with no rollups, no gas fees, and no external layers. During the 10 peak ticks CertiK verified, the network processed 1.518 billion transfers.

The coverage was immediate. GlobeNewswire distributed the press release. The Defiant, TradingView, Manila Times, and dozens of regional outlets picked it up. For a protocol that had operated mostly within its own community, this was the first moment of mainstream technical validation.

What made the record possible is the same architecture that makes Qubic unusual: bare-metal execution, no operating system overhead, tick-based consensus where block production, execution, and finality happen simultaneously. Speed was never the primary design goal. It was a byproduct of building infrastructure meant to support decentralized AI computation at scale.

4. The Monero Experiment: Crypto Mining, Hashrate Dominance, and What It Proved (160–175)

Qubic's relationship with Monero became the most talked-about event in crypto mining during the summer of 2025. What started as the "Monero Experiment" for Useful Proof of Work became a multi-epoch campaign that tested game theory, economic incentives, and network resilience in real time.

Merge Mining Goes Live

Around Epoch 160, Qubic miners began redirecting their idle CPU power toward Monero mining. Mined XMR was sold for USDT, which was then used to buy Qubic on the open market and burn it, creating a deflationary loop tied directly to real computing work.

By Epoch 163, Qubic miners earned roughly $14.20 per week, making Qubic the most profitable CPU-mined coin on the market. A 7950X CPU running through Qubic earned over $2 per day, roughly three times more profitable than mining Monero directly. Across the mining epochs, 2 trillion Qubic were bought back and burned through this mechanism, totaling $3.36 million in cumulative USDT value at the time of burning.

The 51% Demonstration

Through a community vote, Quorum consensus approved a 51% hashrate demonstration over Monero's network. The first attempt was met with sustained DDoS attacks lasting over a week. Qubic's network stayed operational.

On August 11, 2025, a selfish mining strategy was deployed. Qubic miners mined 63 out of 122 blocks in a verified window, crossing the 51% threshold. During Epoch 175 alone, approximately 737 XMR were mined, with 86 billion Qubic purchased and burned at a cost of roughly $206,000. CoinDesk, The Block, Cointelegraph, and Ledger's CTO all weighed in publicly. A $300 million market cap protocol had tangibly demonstrated power over a $6 billion network.

To verify the results, Qubic commissioned Shai Deshe, a former Kaspa developer and one of Qubic's most vocal public critics, to conduct an independent analysis. His selection was deliberate: his reputation as an outspoken skeptic meant he had zero incentive to inflate the findings. His report confirmed that Qubic obtained at least 28% of Monero's actual hashrate, consistent with the 35% perceived hashrate when accounting for the Eyal-Sirer selfish mining strategy employed. He concluded that while 51% of actual hashrate was implausible, the demonstration was significant regardless. He wrote that a project of Monero's stature being disrupted to such a thorough extent by a niche movement should considerably undermine its claim of military-grade security, and attributed Monero's vulnerability to its reliance on ASIC-resistant generic hardware for scarcity. The Qubic team chose not to take over Monero's protocol consensus after internal discussions about potential price impact.

What the experiment did prove, beyond dispute, is that outsourced computations work. Qubic's UPoW model redirected network compute power toward an external productive task, generated real revenue, and validated the blueprint for future use cases including AI workloads.

5. Epoch 175 Halving: Qubic's Largest Emission Cut (August 20, 2025)

The first halving in Qubic's history landed at Epoch 175, approved by the quorum consensus after months of community discussion.

Metric | Before Halving | After Halving |

Burn Rate | 15% | 55% |

Effective Weekly Emissions | 850 billion Qubic | 425 billion Qubic |

Annual Emissions | ~46.8 trillion | ~23.4 trillion |

Projected Supply (End 2025) | ~173 trillion | Actual: ~135 trillion |

The actual circulating supply entering 2026 landed well below projections. The halving, QEarn locks, buyback burns from mining, IPO burns from smart contract launches, and the Supply Watcher's dynamic adjustments worked in concert to deliver a result that exceeded expectations.

The halving also served a structural purpose beyond scarcity. It extended the timeline for miner and Computor rewards, preventing premature depletion and keeping incentives aligned for the network's long-term operators. The Supply Watcher contract continues to fine-tune burn ratios in real time to avoid over-deflation.

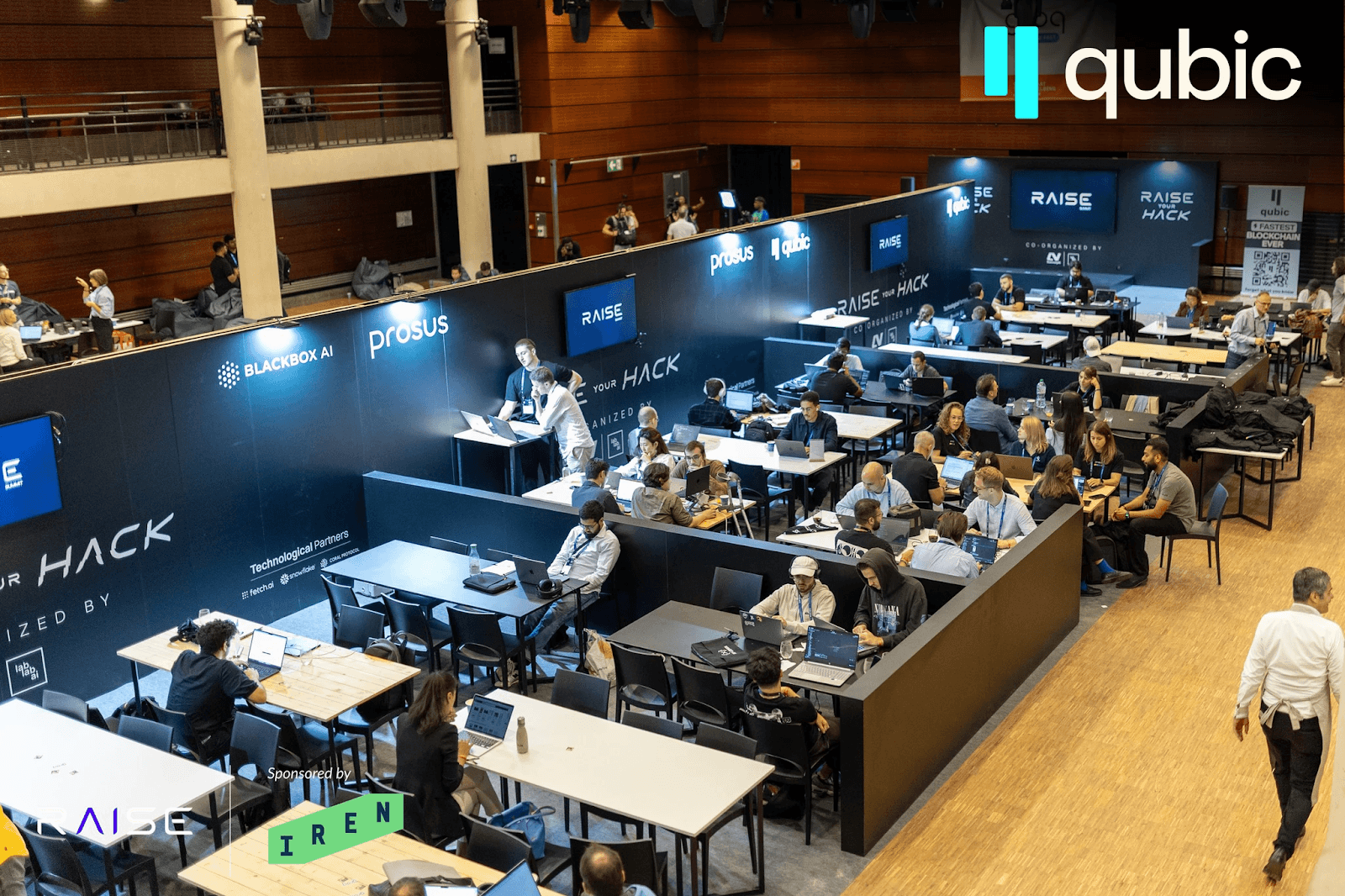

6. Three Hackathons, Thousands of Blockchain Builders

Qubic is written in C++. It doesn't use the EVM. It doesn't use Solidity. Its tick-based architecture, bare-metal execution, and quorum consensus model are fundamentally different from what most blockchain developers have encountered. That complexity is a strength in production, but it creates a steep learning curve for new builders.

The hackathon program was designed to address that directly.

Event | Date | Participants | Teams | Projects |

Madrid Hackathon (with Vottun) | Mar 22–23, 2025 | 127 | 27 | 24 pitched |

RaiseHack (RAISE Summit, Paris) | Jul 2025 | 6,000+ total (400 in Qubic Track) | 22 finalists | 22 demos |

Hack the Future (with LABLAB) | Dec 2025 | 1,654 | 256 | 102 submitted |

The Madrid Hackathon at 42 Madrid Fundación Telefónica was the first time developers deployed smart contracts on the Qubic Testnet in a live setting. More than a competition, it laid the groundwork for understanding how to build on a non-EVM, C++ native chain. The tooling, documentation, and developer feedback that came out of Madrid directly informed the resources available to builders today.

RaiseHack at Europe's largest artificial intelligence conference brought Qubic in front of a global developer audience for the first time, with over $150,000 in grants. Hack the Future, in partnership with LABLAB, drew 1,654 participants and 256 teams, with builders using both Qubic's C++ smart contract infrastructure and EasyConnect integrations for no-code development.

The clearest proof that the hackathon program works is Kairos Tek. Founded by Joobid, who also leads Qubic's Spanish community, Kairos Tek placed at the Madrid Hackathon with EasyConnect, a no-code tool that gives developers and businesses access to Qubic smart contract data without writing a single line of blockchain integration code. They then won first place at RaiseHack with QBuild, a service to help developers build and test smart contracts. EasyConnect has since completed Qubic's full incubation program, passed QA, and is live in production. Joobid went on to represent EasyConnect at MERGE Madrid 2025, presenting on the Binance Main Stage.

From hackathon prototype to live infrastructure tool to international stage, Kairos Tek is the pipeline in action.

7. Ecosystem Expansion: New Projects, New Infrastructure

Between Epoch 100 and 200 we saw Qubic's ecosystem evolve from a handful of tools into a functioning network of projects across DeFi, developer infrastructure, and cross-chain connectivity.

QX became the ecosystem's native decentralized exchange for asset trading. Trading volume hit an all-time high of 100 billion QUs on January 29, 2026, with daily averages settling around 40 to 50 billion QUs. For a network that didn't have a functioning DEX at Epoch 100, this represents meaningful on-chain economic activity. Much of that activity flows through Qubictrade, a full-featured trading interface built by community developer Nik without any grant funding. It is one of several ecosystem tools built independently by developers who saw a gap and filled it on their own, a pattern that says as much about the network's culture as any incubation program.

The Solana Bridge moved from concept to active development. Avicenne Studio completed Milestone 1 approval and kicked off Milestone 2, covering smart contract development on both the Qubic and Solana chains.

Execution fees went live on mainnet on January 14, 2026. Smart contracts now pay proportionally for the computational resources they consume. Contracts that perform more work pay more; efficient code becomes genuinely valuable. The system ties burns directly to real utility rather than arbitrary fixed amounts, adding an organic deflationary mechanism to the network.

RPC 2.0 overhauled Qubic’s integration layer, the API infrastructure that wallets, exchanges, and block explorers rely on to connect to the network. By early 2025, the original system was handling 10,000 requests per minute. Six months later, peak traffic had doubled to over 20,000. The rebuild, which went live on July 1, 2025, replaced the monolithic archiver with a modular architecture: Apache Kafka for data ingestion, Elasticsearch for indexed querying, and per-epoch data archiving for long-term scalability. The new API introduced filtering, pagination, and flexible range queries that weren’t possible before, making it significantly easier for third-party developers to build on the Qubic network.

The broader ecosystem also grew with grants-funded projects like QubiPy (Python SDK), QubicJ (Java infrastructure), QubicTools, QFront, and Easy Connect, each filling specific infrastructure gaps.

8. Neuraxon and the AGI Position Paper: Decentralized AI Research Gets Serious

Qubic published two major research papers during this period, and the reception from the broader artificial intelligence research community exceeded what most AI crypto projects achieve in their lifetime.

The AGI position paper, titled "Human and Artificial Intelligence: Toward an AGI with Aigarth," has accumulated 17,451 reads on ResearchGate since its December 2024 publication. It laid out the theoretical framework for how Aigarth, powered by Qubic's distributed compute network, could evolve toward artificial general intelligence.

Neuraxon followed in November 2025, authored by David Vivancos and José Sanchez. Vivancos is a thought leader at the intersection of neuroscience and AI with over 25,000 hours devoted to AGI research, four published books, and pioneer work spanning fields from virtual reality to neurocomputing since 1995. Sanchez is a cognitive neuroscientist with a PhD from Complutense University of Madrid, a university lecturer at UNIR, and the author of 20 scientific papers in high-impact journals. The paper introduced a bio-inspired neural network framework that moves beyond traditional perceptrons. The architecture features trinary logic (inhibition, excitation, and neutral states), continuous processing where inputs flow as constant streams, multi-timescale computation at both neuron and synapse levels, and neuromodulation inspired by dopamine, serotonin, acetylcholine, and norepinephrine.

The paper has reached 2,918 reads on ResearchGate. The accompanying HuggingFace models tell a stronger story: Neuraxon Life has received 6,270 visits and the Neuraxon Model page has drawn 18,332 visits, with 129 code clones on GitHub.

NeuraxonLife 2 expanded the research further, generating a dataset of 9,794 simulated games capturing the neural architectures of over one million evolved agents. The latest iteration tracks time series data rather than snapshots, following how individual Neuraxons develop through extended sessions of 75+ rounds.

The hybridization of Aigarth and Neuraxon is now actively underway, with integration into the Qubic network targeted for spring 2026.

9. Community and Social Media: Growth by the Numbers

Marketing in crypto is often about volume. Qubic's approach during this period focused on efficiency.

Since October 2025, the team generated over 10 million ad impressions on a total ad spend of $7,042, delivering a 1,300% performance increase. CRM contacts grew 985%, from 497 to 4,904 opted-in subscribers. For context, one PR company quoted $31,500 for an estimated 700,000 impressions. Qubic achieved over 8 million combined impressions for roughly one-ninth of that cost.

From December 1, 2025 through February 13, 2026, the team published 859 posts across X and LinkedIn (a 527% increase) generating 4.44 million impressions (+217%) and 126,960 interactions (+113%). On X, likes hit 73,830, reposts 16,250, and link clicks 18,400. The top performers weren't giveaways: a homepage redesign post reached 328,000 impressions, the Neuraxon Science AMA drove 2,654 interactions, and technical explainers on tick architecture, bare-metal smart contracts, and CertiK's TPS verification each cleared 100,000 impressions. LinkedIn grew 12% to 1,734 followers, with an audience skewing toward business development, engineering, and financial services professionals.

The Ambassador Program scaled from 20 members to over 120 across the globe, organizing events in France, Spain, Vietnam, and Nigeria, and supporting the core team at Token2049 Singapore where Qubic generated over 50 partnership leads and six active integrations. University partnerships took root across Vietnam, Spain, and Nigeria, with initial contact in El Salvador. The Qsletter evolved into a weekly CRM-integrated newsletter reaching over 4,500 subscribers.

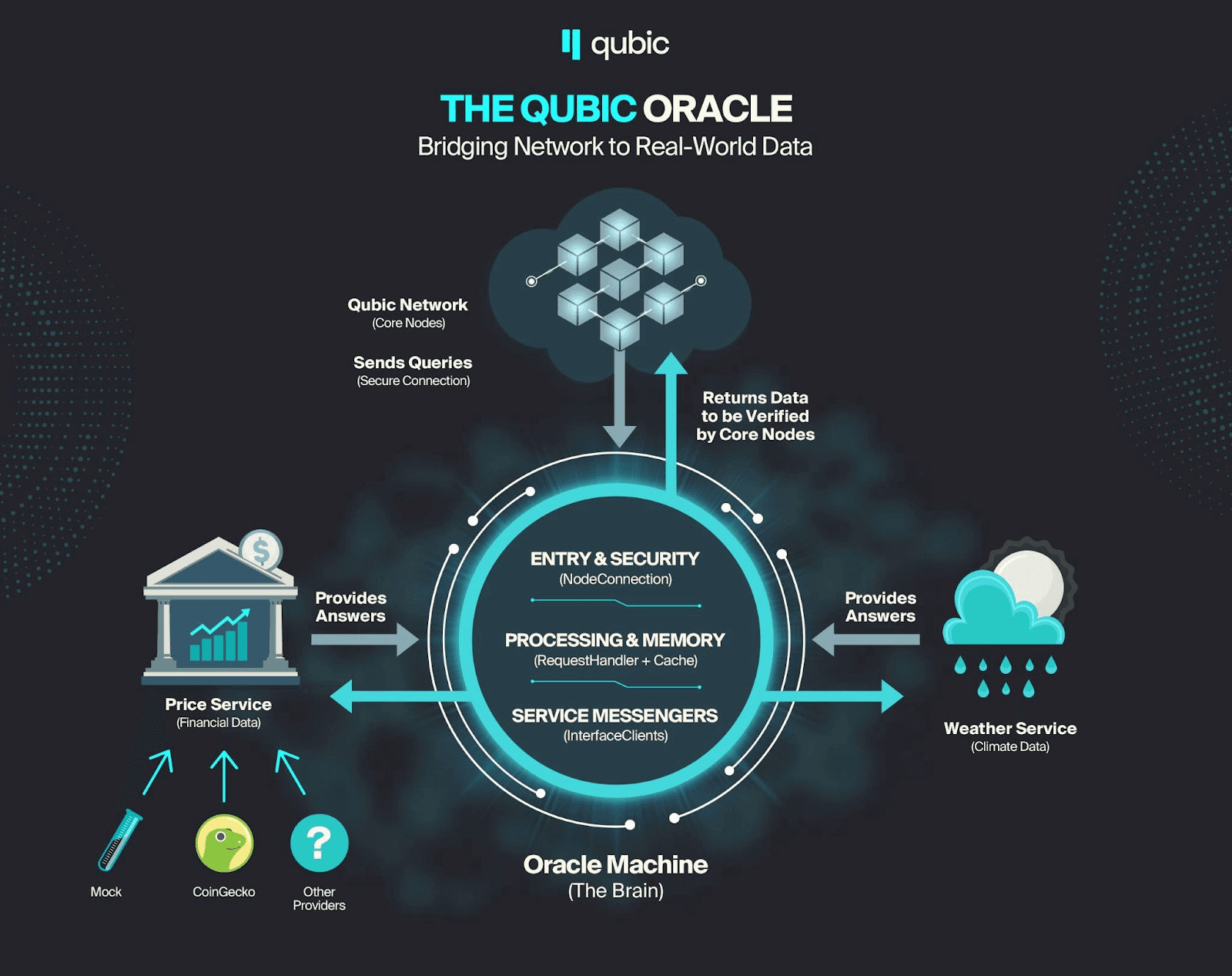

10. Oracle Machines Enter Mainnet Testing (Epoch 200, February 2026)

The tenth milestone is the most recent, and it signals where Qubic is heading next.

On February 11, 2026, Qubic began mainnet testing of protocol-native oracle machines. Unlike external oracle networks like Chainlink, Band Protocol, Pyth, API3, and DIA, Qubic's oracles are embedded directly into the consensus layer. The same 676 Computors that secure transactions and execute smart contracts also verify oracle data, with the standard 451-node quorum consensus required for finality.

Oracle machines act as a bridge between smart contracts and real-world data, feeding information like price feeds, sports scores, sensor readings, and external API responses into on-chain logic through the Qubic Protocol Interface (QPI). Once subscriptions launch, the Oracle project will be considered complete from the core tech side. Computors will be obligated to run oracle machines, with their revenue directly tied to oracle performance.

This unlocks a class of applications that Qubic simply could not host before: DeFi protocols requiring price feeds, prediction markets, data-dependent conditional payments, and most critically, the ability for Aigarth to observe the external world through verified data streams.

What Comes Next

Epoch 200 isn’t a finish line. It’s a launchpad.

The Solana bridge is approaching, with smart contract development already underway on both chains. Neuraxon-Aigarth hybridization is targeting spring 2026 integration directly into the Qubic blockchain, merging computational intelligence with decentralized infrastructure at the protocol level. Oracle subscriptions will make smart contracts capable of reacting to real-world events autonomously. And the second halving looms on the horizon in August 2026, tightening supply even further.

One hundred epochs ago, Qubic had a whitepaper and a working protocol.

Today, it holds speed records that competitors can’t touch. An active developer ecosystem building tools, bridges, and applications. Scientific research with real academic traction, not vaporware, but peer-reviewed progress toward computational intelligence. A deflationary tokenomics model performing ahead of projections, with over 64 trillion already removed from circulation (30T locked in qearn & 34T burned supply). And infrastructure that’s starting to look less like a blockchain experiment and more like what decentralized AI actually requires to function at scale.

None of this happened because of a single team or a single decision. It happened because independent developers wrote tools without funding. Because community members showed up in Discord at 3 AM to debug testnet issues. Because miners redirected their rigs when the math made sense. Because ambassadors spread the word and organized meetups across the globe. Because believers held through the noise.

To every builder, researcher, Computor operator, miner, ambassador, moderator, and community member who contributed to these 100 epochs: this is your milestone too.

Now, let’s keep building.