QUBIC BLOG POST

The Next Evolution of Useful Proof of Work (UPoW)

Written by

The Qubic Team

Published:

Nov 30, 2025

Listen to this blog post

Qubic Formalizes its Economic Mining Strategy

If you've been tracking Qubic, you remember the success of its Useful Proof of Work (UPoW) concept. This approach pivots the consensus model, leveraging economics rather than raw, brute-force computation to achieve dominance and utility.

We’ve already demonstrated the claims, proved the results, and unveiled a completely novel path forward for the Proof of Work paradigm. Let's briefly recap our achievement and then dive into the robust, formalized mechanics preparing us for the next profitable mining adventures.

The Monero Moment: An Economic Domination

Qubic's core innovation lies in UPoW, which utilizes miner compute for useful tasks; specifically training its fully on-chain Artificial Intelligence, AIGarth. However, AIGarth doesn't need all the processing power the network supplies. In the early days, a significant portion was going to waste.

To eliminate this waste and push the boundaries of blockchain technology, the team directed this excess power to mine Monero (XMR) for profit. By topping up native Monero rewards with additional Qubic rewards, we created an irresistible incentive.

The result was immediate and profound: a massive migration of CPU Monero miners to Qubic. At the peak of this experiment, Qubic controlled over 51% of the Monero hashrate, demonstrating a systemic economic takeover against Monero, but also put every Proof of Work coin, including Bitcoin, on notice. While Qubic never acted maliciously, refusing to harm Monero, the event was a seismic marketing success, dominating headlines in major crypto publications for months.

The Proposal: A Formalized, Robust Incentive Structure

The Monero proof-of-concept succeeded far beyond expectations. Now, it's time to build a robust, sustainable, and formalized reward structure for miners who engage in Custom Mining - the mining of any 3rd-party coin through Qubic.

In the Monero experiment, the mined coin revenue was used for flexible purposes: topping up miner rewards or conducting open-market buybacks and burns of QUBIC. These activities were decided by the community vote and the opinion of the devs, making it functional but chaotic. The new proposal formalizes this into a four-layered system designed for maximum profitability, stability, and token value support.

Proposal: Incentive Model for Attracting Miners with Layered Distribution & Burn

This new system is engineered to achieve several key objectives simultaneously:

Establish Qubic mining as consistently more profitable than direct XMR/Tari mining.

Stabilize miner rewards at a predictable premium.

Maintain long-term funding for the Community Contribution Fund (CCF).

Create permanent deflationary pressure on the Qubic token (Qus).

Layer 1: XMR Rewards → Open-Market Qubic Buybacks

The base mechanism creates constant market demand:

All 3rd-party coins mined (e.g., XMR) are immediately sold.

The proceeds are used to buy Qubic on the open market.

These purchased Qus are then converted into the reward pool for the subsequent layers.

Impact: This tightly links real, external mining utility to continuous buy pressure on the Qubic token.

Layer 2: Profitability Booster (Target: 125% of XMR + Tari)

This is the core incentive to attract and retain CPU miners. The system monitors the profitability of external CPU mining benchmarks (Monero only and Monero + Tari merge-mining).

If Qubic mining profitability falls below 125% of the external benchmark, a portion of the Layer 1 Qus pool is used to subsidize miner payouts.

Qubic Profitability = 1.25 * (XMR + Tari Profitability)

Impact: It guarantees Qubic is the most attractive destination for CPU hashpower, securing the network's UPoW compute capacity.

Layer 3: CCF Support (25% Allocation)

Sustainability requires resources. After the Layer 2 profitability target is met:

25% of the remaining Qus are allocated to refill the Community Contribution Fund (CCF).

Impact: This ensures stable funding for grants, infrastructure development, and long-term ecosystem growth.

Final Layer: Burn Mechanism

After buybacks (L1), profitability subsidies (L2), and CCF funding (L3), any remaining Qus are dealt with decisively:

All remaining Qus are burned.

Impact: This creates permanent, verifiable deflationary pressure, rewarding long-term holders by increasing the scarcity of the Qubic token.

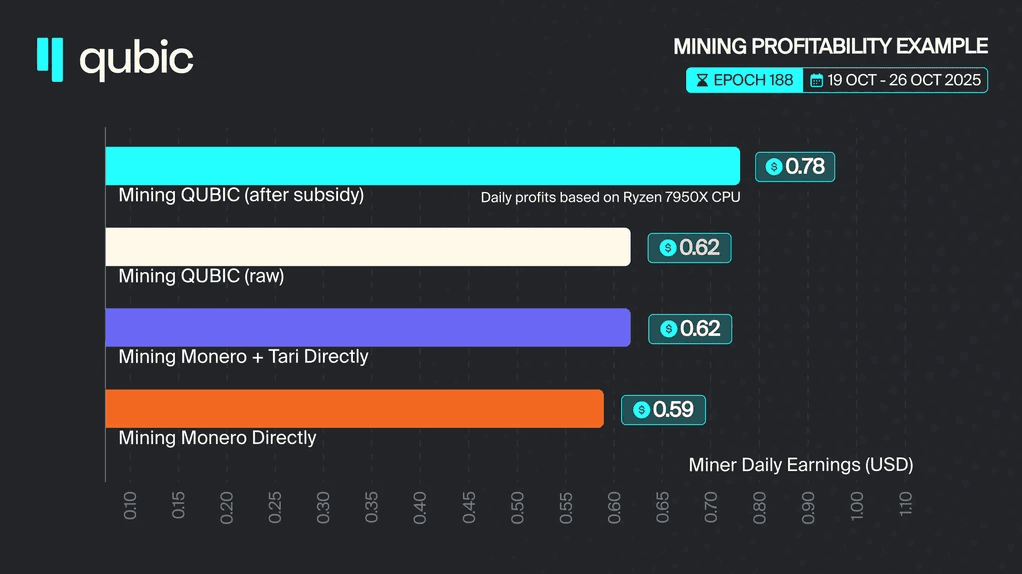

Practical Example: The Power of the Subsidy

Let's look at the numbers to see how this proposal dramatically shifts the profitability landscape for miners.

Mining Scenario | Daily Profit (USD) | Relative Profitability |

Direct XMR Mining | $0.59/day | 100% |

Direct XMR + Tari Merge | $0.62/day | 105% |

Qubic Mining (Raw) | $0.62/day | 105% |

Qubic Mining (After Subsidy) | $0.78/day | 125% |

In this example, by using the Layer 2 Profitability Booster to target a 125% premium over the combined XMR + Tari profitability ($0.62), Qubic ensures the miner walks away with $0.78/day.

This formalized structure takes the proven economic strategy and embeds it into the core reward mechanism. It’s a sophisticated, self-sustaining loop that rewards miners, supports the ecosystem, and strengthens the Qubic token through constant buy pressure and deflationary burn.

The structure reasserts Qubic’s Useful Proof of Work as profitable Proof of Work.

—-

🌐 Join the Revolution

Be early. Be active. Be recognized.

Join the discussion on X, Discord, and Telegram.

Visit the Qubic.org network to become a Computor, miner, or innovator.